12-3pm

RSVP 604.828.9095

12-3pm

RSVP 604.828.9095

FIND your Water Shut Off

REGISTER Your Wood Stove & Fireplace

August 2025 Market Insights

OPEN HOUSE Sat/Sun 2-4pm

Large 3 Bedroom plus Den

Point Grey

Exquisite Home with Rooftop Deck

Vancouver East

Home with Rental Suite

You NEED to Register your Wood Stove & Fireplace

This Fantastic LARGE Home, has a Fantastic NEW PRICE

#41, 1190 Falcon Drive Coquitlam

604.828.9095

Don't Purchase the Car

Open House Sat/Sun 2-4pm

Coquitlam / Port Moody Border

3 Bedroom PLUS Den Townhouse

Close to 1900 sq.ft on one Level

Private Garage and Workshop

Cloverdale

2 Level Home with 4 Bedrooms

Burnaby Village Museum

Free Admission and Carousel Rides

DON'T Purchase the Car

Heat Pump REBATE for Condos

APPLY for the Home Owners Grant

BEFORE Paying Property Tax

May 2025 Market Insights

Queens Park, New West

2,800 sq.ft of Living Space

Downtown New West

One Level Sub-Penthouse

Port Moody Art Shuffle June 20

APPLY for your Home Owner Grant BEFORE Paying Property Tax

MOVE Heavy Items Effortlessly!

Renfrew, Vancouver

Custom Built Luxury Home, 7 Bed, 7 Baths

Ideal for mult-family

Fleetwood, Surrey

Private & Pristine home

Shredding Events

MOVE Heavy Items Effortlessly!

Cleaning Your Front Load Washing Machine

Consider an Insurance Ryder

Queens Park New West

Spectacular Home

Port Moody

2 Bed / 2 Bath Corner Suite

Fingerling Festival Port Moody

May 3rd, 11am - 3pm

Cinco de Mayo Events

Consider an Insurance Ryder

Declutter your counter with this hidden drying rack

CONFIRM your Earthquake Deductible

Feburary 2025 Market Insights

2025 Tri-City FREE Home Show

Vancouver West

3 Bed, 2.5 Bath Executive Townhouse

Queens Park, New Westminster

Ideal Home, No Shared Walls, No Strata Fees

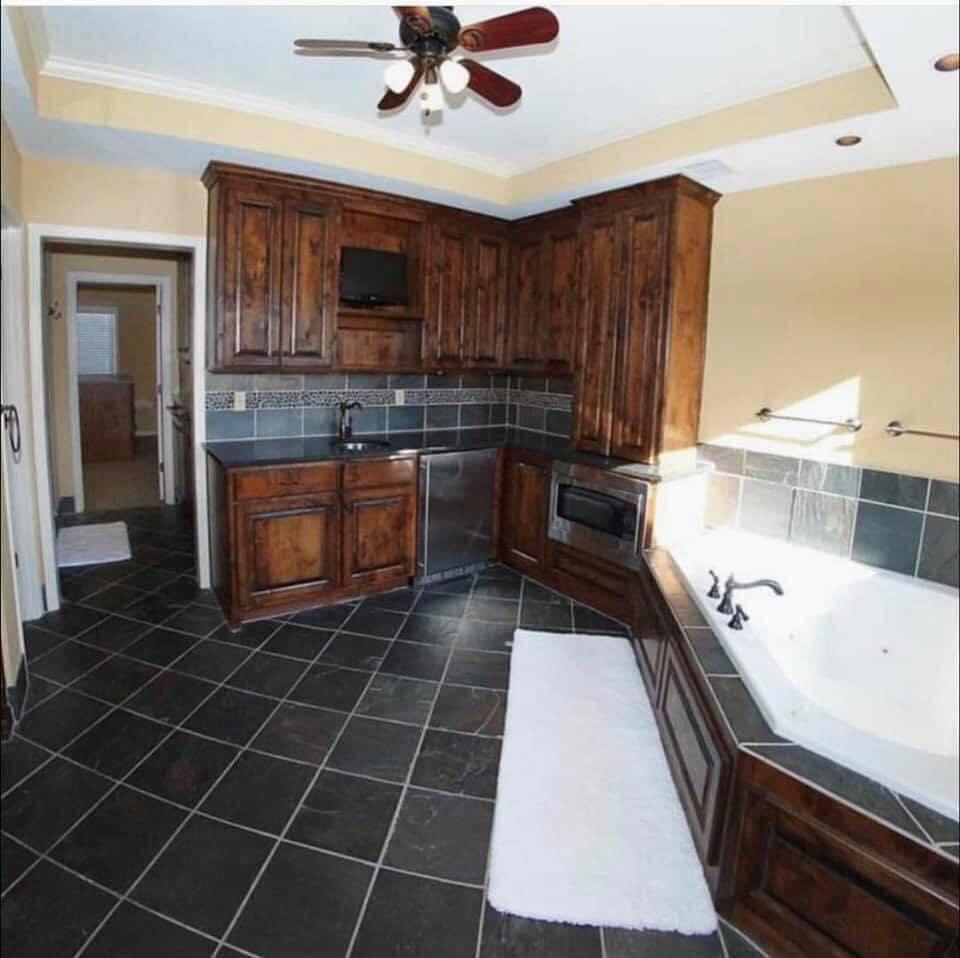

This wonderful family was referred to me at the start of their home ownership adventure. They wished to remain in the Coquitlam area so their teenagers would be able to continue in the same schools, and maintain their friendships.

They didn’t expect to find the home of their dreams as quickly as they did, but when we viewed this property, they knew it was the one.

They are so happy in their spacious new home, it provides everyone in this close-knit family enough privacy and a backyard retreat to enjoy warm summer days together. It even has a fantastic workshop for when the desire occurs, and, in walking distance to …. well, just about everywhere.

If you are looking to make the move, let’s start with a coffee and a chat to start your home ownership journey

Shannon 604.828.9095

CONFIRM your Earthquake Deductible

Speculation & Vacancy Tax Declaration

2025 St. Patrick's Day Events

Tsawwassen Family Home w/Resort Style Amenities

Burnaby North, 1 Bedroom Townhouse